Everything You Need to Know About Filing a Consumer Proposal in Alberta.

Stop the confusion. Get the facts, download the forms, and file directly with a Trustee.

OUR MISSION

To provide Albertans, and eventually, Canadians any where in Canada, with the independent tools, strategy, and confidence to navigate insolvency without paying thousands in unnecessary consulting fees.

WHO WE ARE

We are an independent educational resource founded on a simple belief:

Restructuring your finances shouldn't cost you your dignity or your savings.

A Note From The Founder: Why I Built This

I didn't build this kit because I'm a lawyer or an accountant. I built it because I was a client walking this path right now.When I realized I needed to file a Consumer Proposal, I was overwhelmed. Like many Albertans, I hired a debt consulting agency to help me navigate the process.To be clear: The service they provided was excellent. They were professional, kind, and organized. I have nothing bad to say about the quality of their work.However, once the process was moving, I realized a hard financial truth: I had paid over $2,000 for organization I could have done myself.The "Representation" was largely administrative work -- gathering documents, filling out spreadsheets, and calculating my budget. These are things I am fully capable of doing, and likely, so are you.Think of it like moving a house: You can pay full-service movers to pack every box for you (expensive luxury), or you can pack the boxes yourself and just hire the truck (DIY savings).When you are in debt, you need every dollar. Had I known I could simply download a guide, organize my own file, and walk directly into a Trustee's office for free, I would have saved that $2,000 and used it to pay down my debt instead.My Mission: I built this platform to be the "DIY Packing Kit." I want to give you the exact templates and strategies you need to be "Trustee Ready" -- so you can get the same professional result I did, but keep your hard-earned money in your pocket.— The Founder, ConsumerProposalGuide.ca

INDEPENDENT

(Unbiased & Unowned)

We are NOT Licensed Insolvency Trustees, Financial Advisors, or Lawyers. We are not owned by any debt consulting agency, bank, or creditor. Because we have no corporate overlords, our content is objective. We answer only to our readers, not to a board of directors.

TRANSPARENT

(Radical Honesty)

We believe you deserve to know exactly who benefits from your financial decisions. We are funded strictly by the sale of our DIY Kits and transparent affiliate partnerships. We do not accept "kickbacks" to steer you toward specific Trustees or bad loans.

PRAGMATIC

(Education, Not Representation)

We provide the roadmap; you drive the car. We offer educational preparation tools, not legal representation. We empower you to take control of your own financial restructuring without the need for expensive hand-holding.

Articles

Consumer Proposal vs. Bankruptcy in Alberta: The Surplus Income Trap

Debt Consultants vs. Insolvency Trustees: Avoid the $2,500 Fee

How to Finish Your Proposal 2 Years Early: 5 Sources of Hidden Cash

Buying a House After Insolvency: 5 Steps to Approval

Ready to File? Get the Toolkit.

We have compiled all the required forms, budget templates, and checklists into one downloadable package.

The Assessment & Vetting Pack

For the Researcher.

"I just want to know if I qualify and what to ask the Trustee."

The Insolvency Roadmap (PDF)

"Green Light" Readiness Checklist

Trustee Vetting Interview Questions

Document Gathering Checklist

The Independent Prep Kit

For the Action Taker.

"I want the forms and spreadsheets to file my proposal today."

Everything in The Assessment & Vetting Pack

Hardship Letter Template

The Consumer Proposal Master Workbook (The Launchpad) - The essential spreadsheet to prepare your file before you meet a Trustee:

Asset Equity Calculator: Calculate the value of your car or home so you don't get pushed into a higher payment than necessary.

Form 79 Budget Simulator: A copy of the official government form. Check if your income is high enough to trigger extra payments before you file.

Master Creditor List: List every debt you owe in one place. If you forget to list a creditor, that debt might not be erased.

The Complete

Phoenix Strategy Bundle

For the Future Planner.

"I want to file, but I also wanna buy a house in 3 years."

Everything in The Independent Prep Kit

eBook: "The Phoenix Strategy"

Your Own Consumer Proposal Management System that includes: - Your command center for the next 5 years. Includes:

Payment Tracker: Track every payment so you never miss a deadline or worry about bank errors.

The Accelerator: Calculate how much time you can save by paying a little extra each month.

The Scoreboard: Track your credit score monthly to watch your financial health recover.

The 30% Watchdog: Tells you exactly when to stop spending on your credit card to protect your credit score.

Dispute Log: Track your phone calls and letters when you need to fix errors on your credit report.

Milestones: A checklist to keep you motivated by crossing off big wins like "Surviving Year 1" or "Reaching 650 Credit Score."

LAUNCH SALE ALERT!

Use limited-time code LAUNCHAB

for huge savings while it lasts!

RECOMMENDED FINANCIAL TOOLS

Disclosure:

We are an independent educational resource. Some links below are affiliate partners. If you open an account, we may receive a commission at no cost to you. We only list tools that are safe for insolvency filers.

"Safe Haven" Banking

When you file a Consumer Proposal, you must bank at an institution where you owe no money to avoid the "Right of Offset."EQ Bank (Top Pick)Why we like it: No monthly fees, high interest on every dollar, and completely independent from the "Big 5" banks.

Best For: Your Emergency Fund and "bills" account.

Neo MoneyWhy we like it: Acts like a spending account but earns high interest. Great app for tracking daily spending.

Best For: Daily spending (Groceries/Gas).

WealthsimpleWhy we like it: No monthly fees. Your money earns interest and you can also open multiple accounts like TFSA, FHSA, and RRSP, and self-invest without overly expensive fees.

Best For: Growing your money and setting up registered and non-registered accounts.

Finding a Trustee

Need to file? These firms are known for free consultations and fair treatment.Bromwich+Smith

(Debt Relief Specialists)

800 5 Ave SW #800,

Calgary, AB T2P 3T6

+1 855-884-9243Hudson & Company

(Local Independent Experts)

625 11 Ave SW Suite 200,

Calgary, AB T2R 0E1

(403) 265-4357MNP Debt

(National Reach)

600 Crowfoot Crescent NW

Unit 340

Calgary, AB, T3G 0B4

(587) 288-5269

Credit Rebuilding

You cannot fix an R7 rating with cash. You need new, positive trade lines.

Neo Secured CreditThe "Guaranteed" Card: No hard credit check. Guaranteed approval.

Low Deposit: Start with as little as $50 security funds.Home Trust Secured VisaThe "Classic" Rebuilder: The industry standard for post-insolvency credit repair.

Reports To: Both Equifax and TransUnion reliably.

Credit Monitoring

You must audit your credit report to ensure the "R7" rating is applied correctly and falls off when it should.Borrowell

Free Score: Check your Equifax score weekly for free.

Rent Reporting: Use their "Rent Advantage" to report your rent payments to the bureau.Credit Karma

Free Score: Check your Transunion score weekly for free.

Tax filing: You may file your own taxes via Credit Karma, powered by Turbo Tax.

Consumer Proposal vs. Bankruptcy in Alberta: The Surplus Income Trap

Earning Over $2,666? Why Bankruptcy Might Cost You Double

If you live in Alberta and you’re drowning in debt, the word Bankruptcy sounds terrifying. But for many Albertans with steady jobs, it’s not just scary—it’s mathematically the wrong choice.The reason lies in a government rule called Surplus Income.

In 2025, the Office of the Superintendent of Bankruptcy (OSB) sets specific income thresholds. These numbers determine how much you are "allowed" to earn before the government penalizes you for going bankrupt.

The Magic Number: $2,666 (Single Person)

If you are a single person and your net (take home) pay is higher than the current threshold (approximately $2,666/month), bankruptcy becomes expensive. For every dollar you earn above that limit, you must pay 50% of it to your creditors.

The 2025 Bankruptcy "Penalty" Thresholds

If your net household income is above these lines, Bankruptcy will seize 50% of your surplus.

| Household Size | Net Income Limit |

|---|---|

| 1 | up to $2,666 |

| 2 | up to $3,319 |

| 3 | up to $4,079 |

| 4 | up to $4,953 |

| 5+ | up to $5,622 |

The Scenario:

• You take home $4,000 a month.

• The Surplus Limit is approx. $2,666.

• You are $1,334 over the limit.

The Bankruptcy Penalty: Because you have surplus income, you must pay 50% of that surplus ($667/month) into your bankruptcy. Furthermore, your bankruptcy is automatically extended from 9 months to 21 months.

• Total Cost: $14,000 + loss of assets.

The Consumer Proposal Advantage: A Consumer Proposal is different. It is a fixed negotiation, not a punishment on your income.

• You could offer your creditors $300 per month for 60 months.

• Total Cost: $18,000.

• The Win: You keep your assets (like your truck or tax refunds) and your payment never changes, even if you get a raise, work overtime, or get a bonus.

The Bottom Line: If you have a good job but bad debt, bankruptcy punishes your income. A Consumer Proposal protects it. Don't sign anything until you’ve run the numbers.

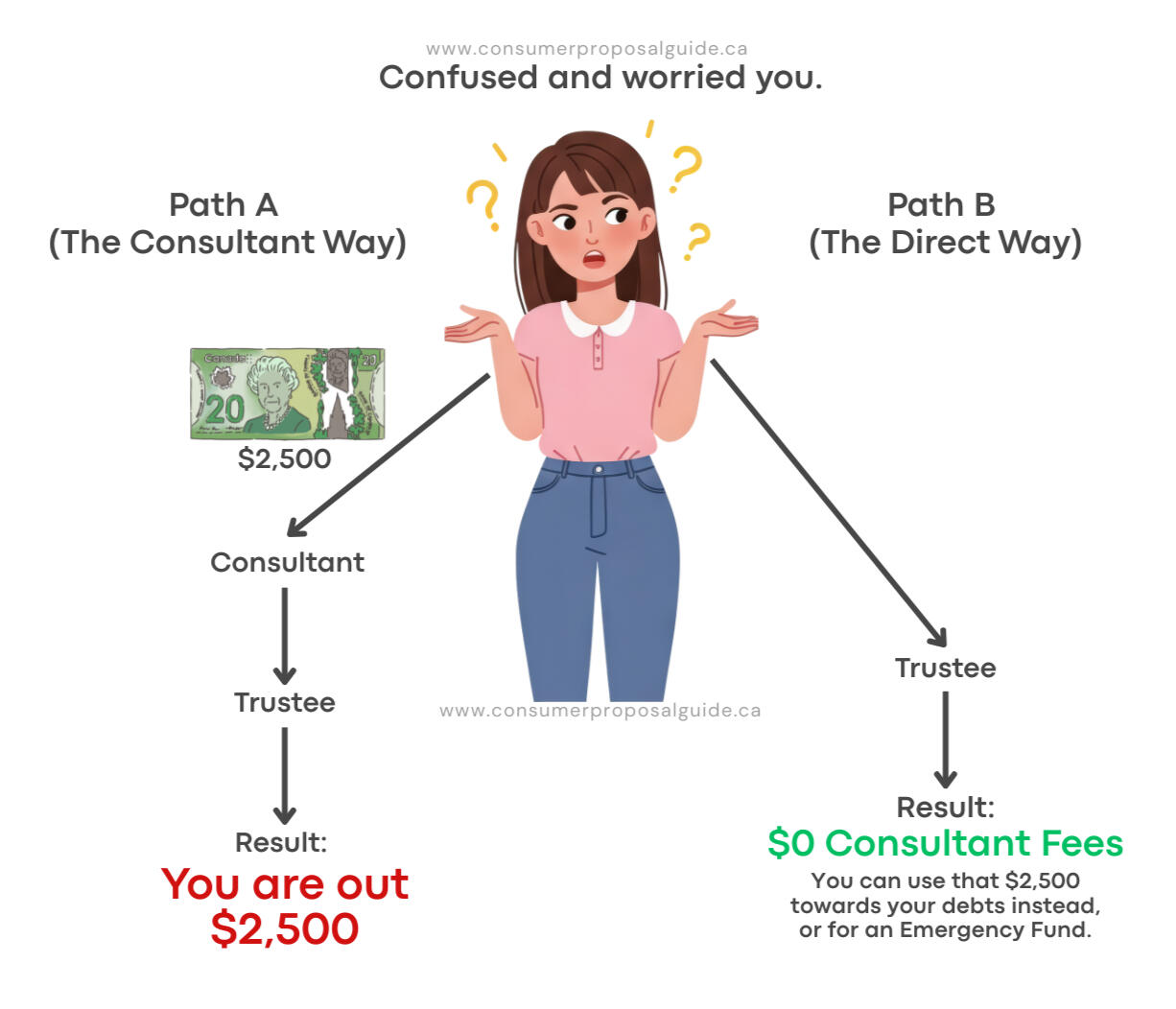

Debt Consultants vs. Insolvency Trustees: Avoid the $2,500 Fee

The $2,500 Mistake: Why You Don't Need a "Middleman"

December 14, 2025

There is a dirty secret in the Alberta debt industry. If you Google "Debt Relief Alberta," the top results often aren't Licensed Trustees. They are Unlicensed Debt Consultants.

These companies look official. They have slick websites and promise to "represent you" against the Trustee. They will sit you down, organize your paperwork, and charge you a fee -- the good ones allow for some form of payment arrangement like over the course of the next six months -- but often $2,500 or more -- payable upfront.

Here is the truth they won't tell you:

They Cannot File Your Proposal Only a Licensed Insolvency Trustee (LIT) is federally licensed to file a Consumer Proposal in Canada. A consultant simply takes your money, gathers your info, and then hands you off to a Trustee anyway.

The Trustee Assessment is Free Consultants charge you for a "Financial Assessment." By law, a Licensed Insolvency Trustee must provide this assessment for free during your initial consultation. You are paying $2,500 for something that costs $0.

The "Advocacy" Myth Consultants claim they get you a "better deal." But a Consumer Proposal isn't a haggle at a flea market; it's a math equation based on your assets (Liquidation Value) and your budget. No amount of "advocacy" can change the value of your truck or your salary.

Save Your Money

If you have $2,500 to pay a consultant, you have $2,500 to pay off your debt.

The Solution: Get organized yourself. Use a simple checklist to gather your documents, then walk directly into a Trustee’s office. You will get the same result and keep $2,500 in your pocket.

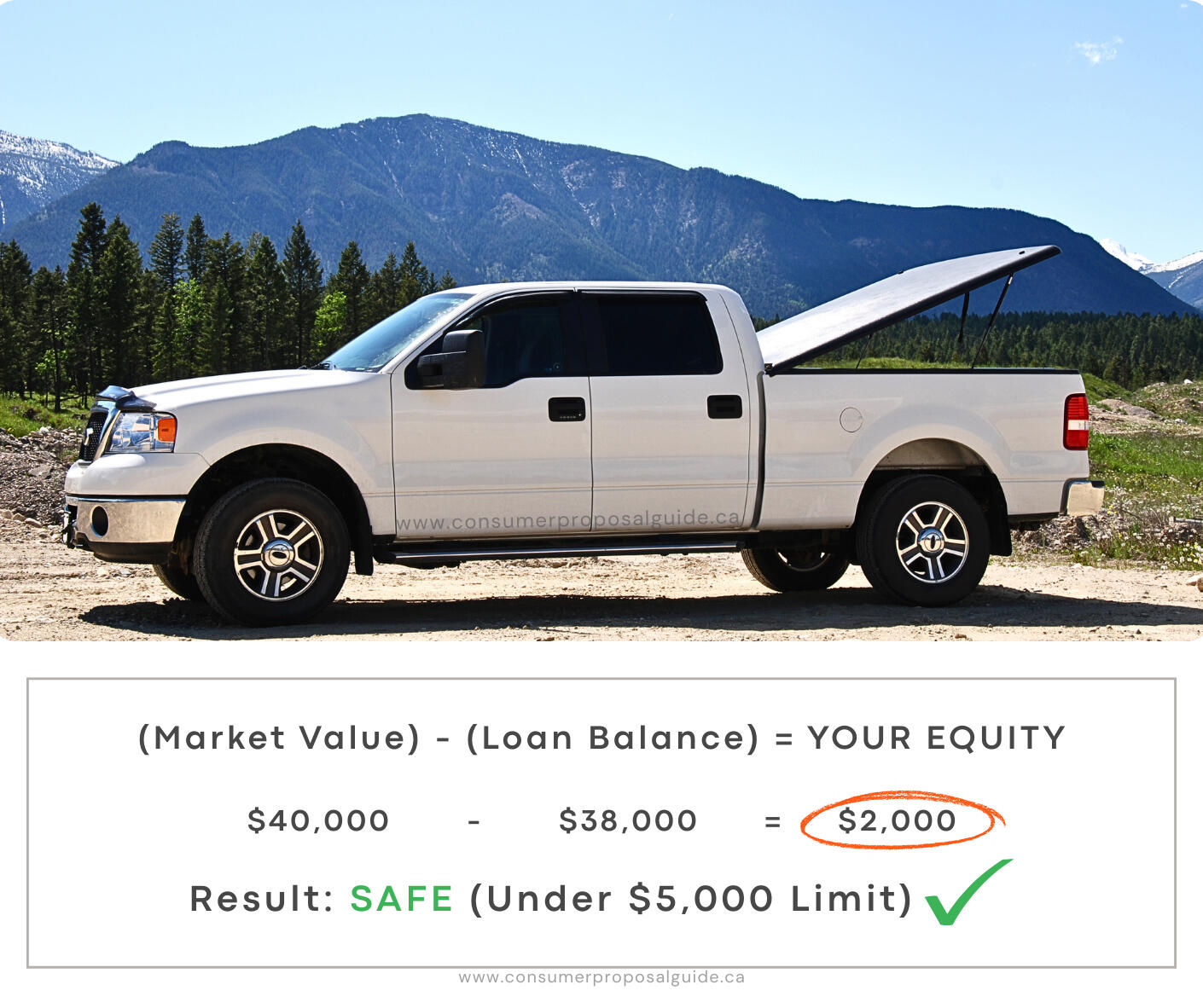

Alberta Insolvency Exemptions 2025: Keep Your Truck

The $5,000 Rule: How to Keep Your Truck in a Proposal

December 14, 2025

In Alberta, a truck isn't just a vehicle; it's often a livelihood. The biggest fear most people have when filing a Consumer Proposal is, "Will they take my keys?"

The answer lies in the Alberta Civil Enforcement Act.

In Alberta, you are allowed to keep one motor vehicle with up to $5,000 in equity.

Understanding "Equity" vs. "Value"

This is where most people get confused. The government doesn't care what your truck is worth; they care what you own of it.

Scenario A (The Paid-Off Truck):

You own a 2015 F-150 worth $20,000.

It is fully paid off (Loan = $0).

Equity: $20,000.

Result: You are $15,000 over the exemption limit. To keep the truck, you would likely have to pay that $15,000 into your proposal over 5 years.

Scenario B (The Financed Truck):

You own a 2024 Ram 1500 worth $60,000.

You have a bank loan on it for $58,000.

Equity: $2,000.

Result: You are under the limit. Your truck is 100% safe. You just keep making your monthly truck payments directly to the lender, and the Trustee cannot touch it.

The "Tools of the Trade" Bonus

If you are self-employed and use your vehicle as a primary tool for your job, Alberta offers a separate "Tools of the Trade" exemption (up to $10,000). Always ask your Trustee if you qualify for this higher limit.

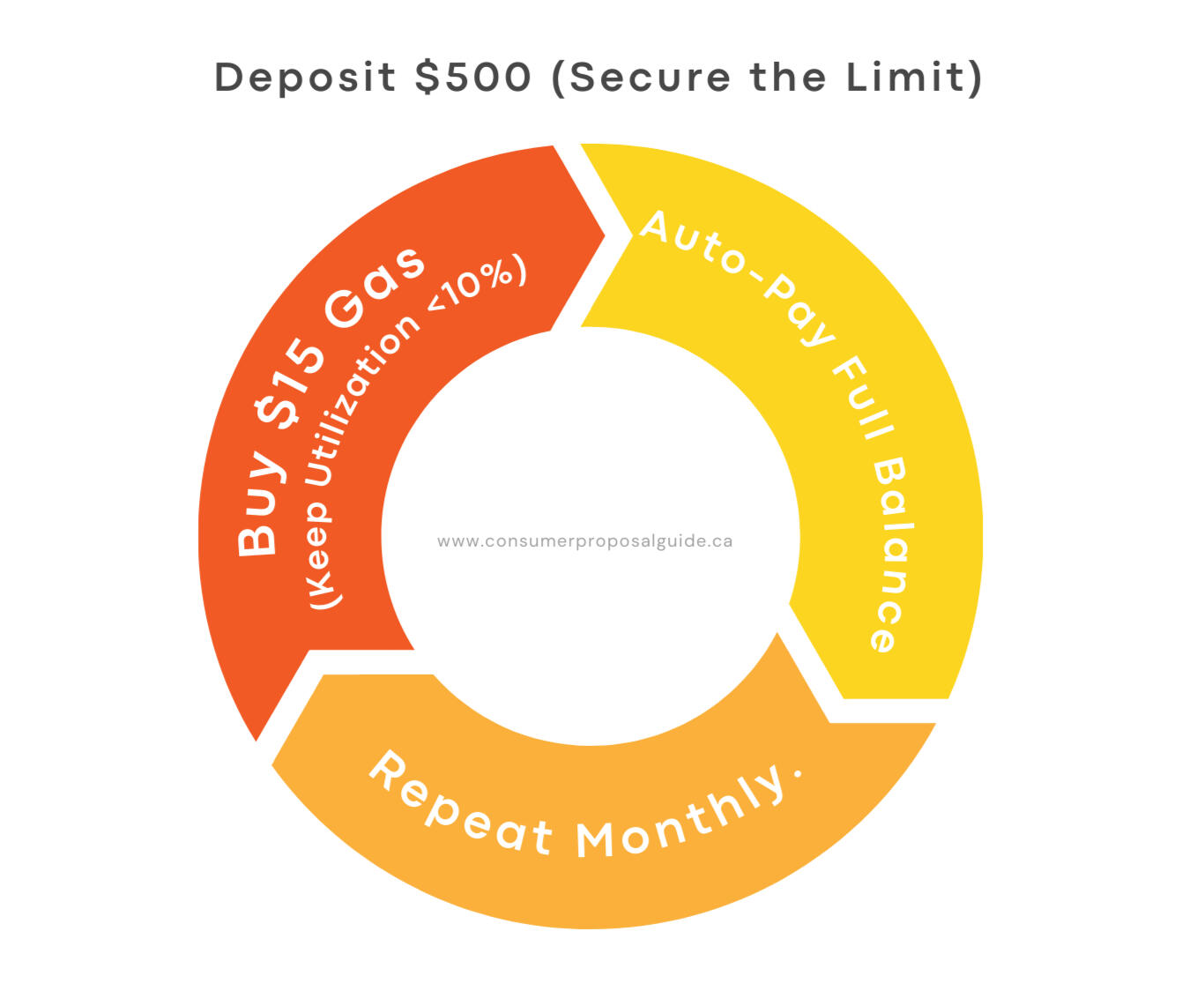

How to Rebuild Credit After a Consumer Proposal (R7 Rating)

Your Credit Score Isn't Dead—It’s Just Frozen.

December 14, 2025

Filing a Consumer Proposal puts an R7 rating on your credit report. It looks bad, but unlike an R9 (Bankruptcy), it signals that you are paying your debts.

The biggest mistake people make is waiting until the proposal is finished (3-5 years later) to start fixing it. You must start on Day 1.

When you file a proposal, your unsecured credit cards are cancelled. You are now a "cash-only" consumer. But you cannot build a credit score with cash. You need a Secured Credit Card.

How It Works

A secured card requires a security deposit (e.g., $500). That deposit becomes your credit limit. Because the bank has no risk, you are guaranteed approval, even while in a proposal.

The Rebuilding Strategy:

Get the Card: We recommend cards like Neo Secured or Home Trust (see our Tools page) as they report to Equifax as a regular credit card.

The "Netflix" Trick: Put ONE small recurring bill on the card (like Netflix). I personally use mine to pay for my prescriptions because I can earn cashbacks by using my Neo Secured Card with my pharmacy.

The Auto-Pay: Set the card to pay itself off automatically from your chequing account.

Hide It: Lock the card in a drawer. In my case, I hide it and only take it with me when I know I'm picking up a prescription.

The Result:

Every month, a "Paid as Agreed" status is sent to Equifax. By the time you finish your proposal, you will have years of perfect history waiting for you, skyrocketing your score the moment the R7 rating drops off.

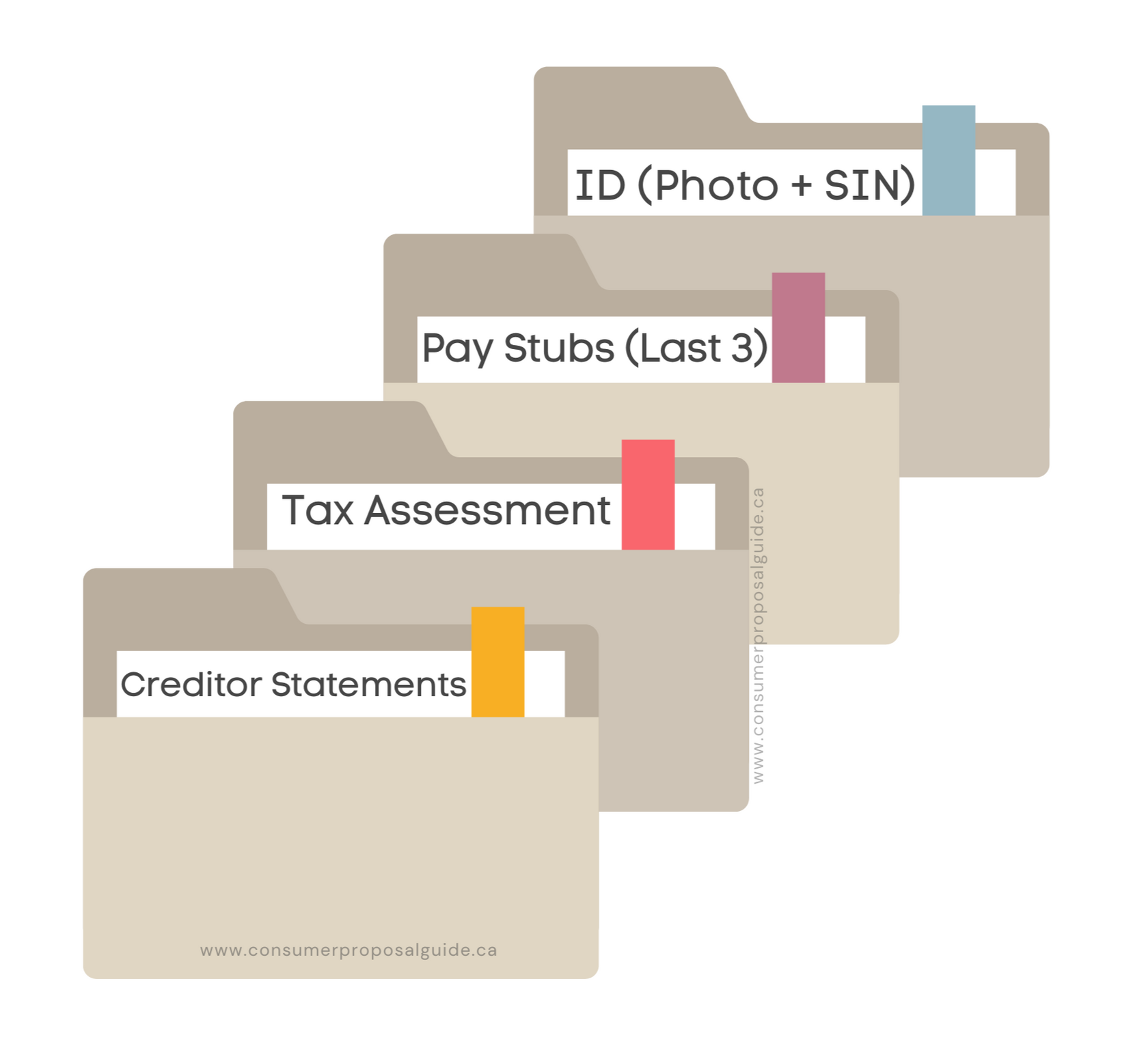

4 Documents You Need Before Calling a Trustee in Alberta

Walk In Like a Pro: What to Bring to Your Insolvency Meeting

December 14, 2025

Walking into a Trustee's office is intimidating. You feel judged. You feel disorganized.

The best way to cure that anxiety is preparation. When you walk in with a neat folder of documents, the Trustee sees you as a "serious" candidate who is ready to fix their life, not just someone looking for an easy way out.

The "Form 79" Essentials

Every insolvency filing in Canada is built on a government document called the Statement of Affairs (Form 79). The Trustee fills this out, but YOU must provide the data.

Bring These 4 Things:

Identification: Two pieces. One must have a photo (Driver's License) and one must prove your SIN (Tax assessment or SIN card).

Income Proof: Your 3 most recent pay stubs. If you are self-employed, bring your T2125 or last 6 months of bank statements.

Tax Data: Your most recent Notice of Assessment from the CRA. This is crucial because if you haven't filed your taxes, the proposal cannot proceed.

The "Debt Shoebox": Bring every statement, collection letter, and scary envelope you have.

Don't Hide Anything

The Trustee isn't the police. They are officers of the court there to help you deal with the debt. If you hide an asset (like a savings bond or a car you "sold" to your brother), it will be found, and it will cancel your proposal. Full disclosure is your best protection.

Will Creditors Accept Your Consumer Proposal?

6 Factors That Decide Your Proposal Vote

December 14, 2025

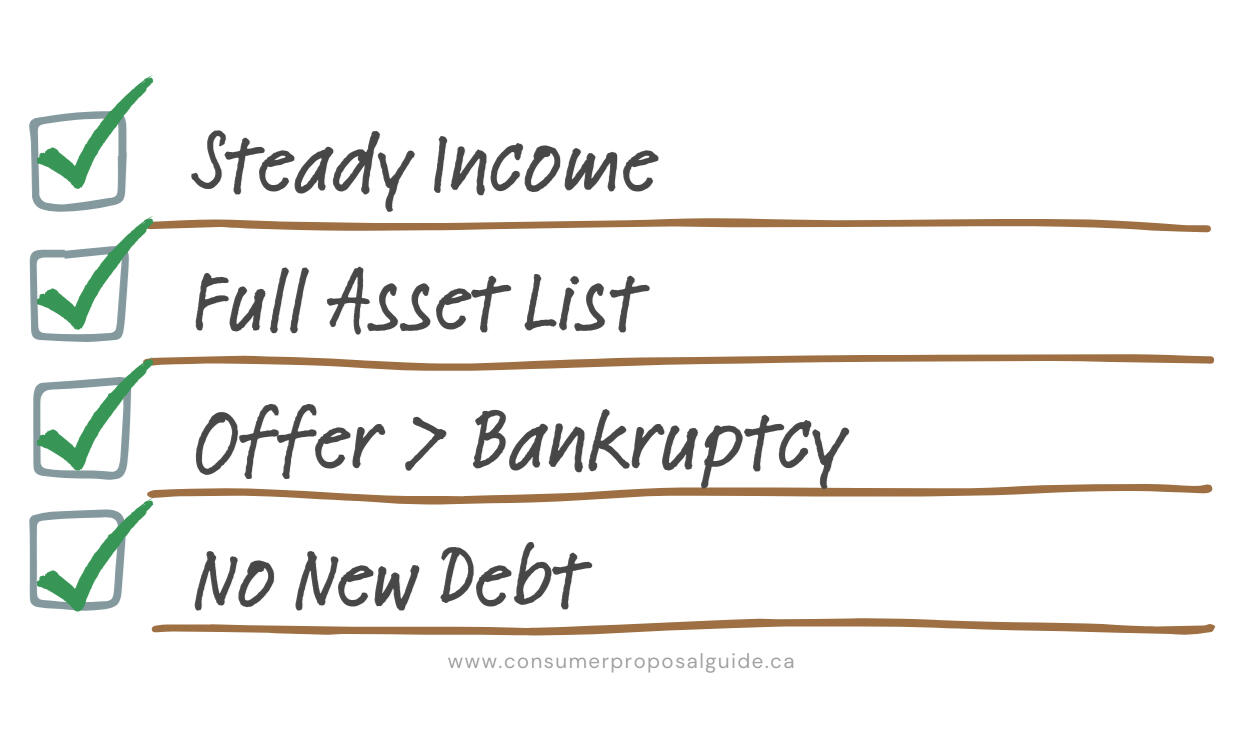

Submitting a Consumer Proposal is a negotiation. You are offering to settle your debt for less than you owe. For the proposal to pass, creditors holding 50% + 1 of the debt value must vote "Yes."

How do they decide? It’s not personal; it’s a calculation. Here is the scorecard most major banks use:

Income Stability Creditors need to know you can actually make the payments. If you are unemployed with no prospects, they may prefer Bankruptcy. If you have a steady job, they prefer a Proposal.

Asset Disclosure Honesty is non-negotiable. If a creditor suspects you are hiding a cabin at the lake or a classic car, they will vote "No" immediately. Full disclosure builds the trust required for a deal.

The "Bankruptcy Comparison" Test This is the golden rule. Your proposal must offer them more money than they would get if you filed for Bankruptcy. If a Bankruptcy would give them $5,000, your Proposal needs to offer $7,000+.

Recent Debt Accumulation Did you run up your credit cards right before filing? This is a red flag called "loading up." Creditors often reject proposals where the debt is less than 6 months old.

The Personal Appeal Factor While math drives the decision, context matters. Without a personal explanation, you are just a number on a spreadsheet. Many successful filers submit a specific "Hardship Letter" to the voting officer explaining the life events (like divorce or medical issues) that led to the debt. This humanizes the file and can sway a borderline vote. We include a pre-written template for this letter in our Independent Filing Kit to help you frame your story effectively.

The "Cents on the Dollar" Formula Major Canadian banks often have internal targets for how much debt they are willing to forgive. It is a delicate balance: offer too little, and you get rejected; offer too much, and you waste thousands of dollars. Knowing the specific "sweet spot" percentage that banks aim for is critical for acceptance. Our Filing Kit breaks down this exact percentage so you can calculate a winning offer without overpaying.

Preparation Wins the Vote

Creditors are not your enemy; they just want a fair deal. By understanding their scorecard -- and presenting a proposal that hits their "Green Flags" while using the Hardship Letter to explain the "Red Flags" -- you drastically increase your odds of acceptance. Don't leave your financial future to chance. Walk in prepared.

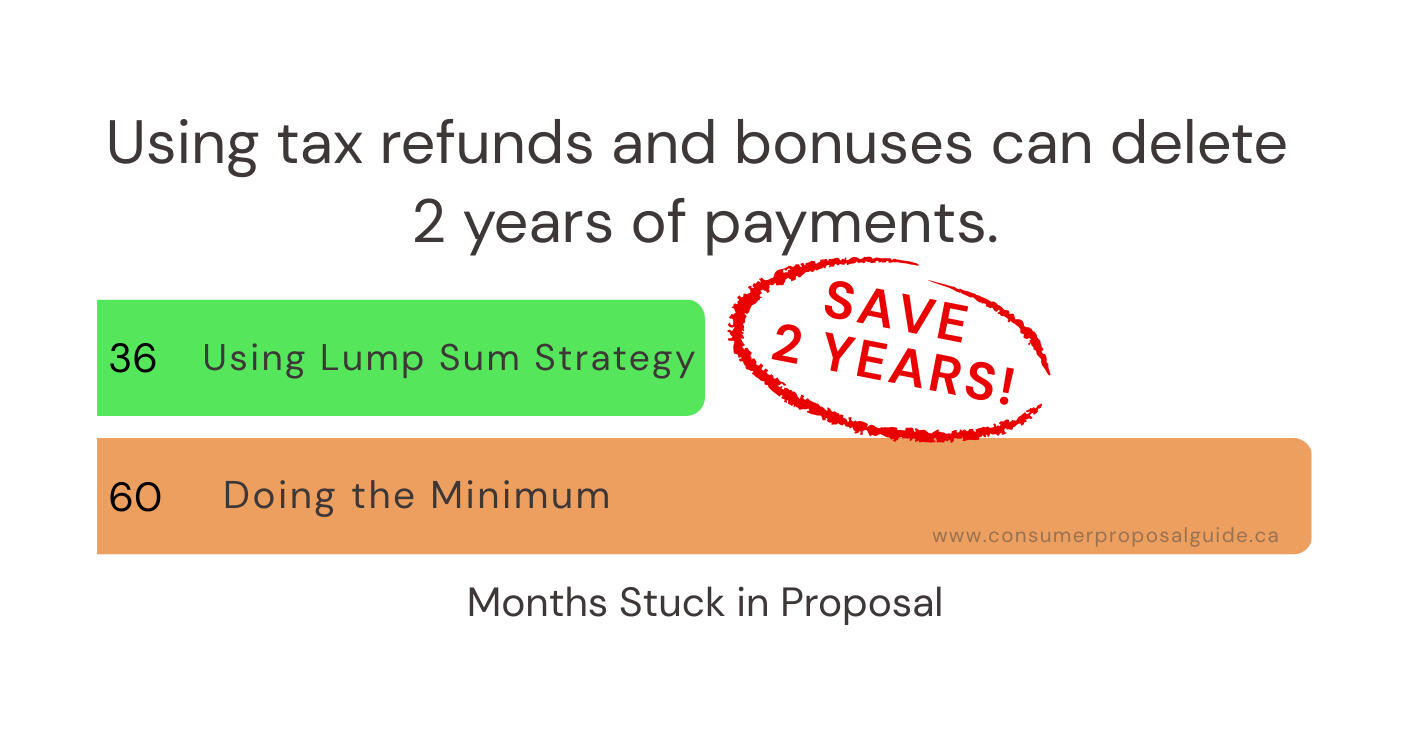

How to Pay Off Your Consumer Proposal Early

How to Finish Your Proposal 2 Years Early: 5 Sources of Hidden Cash

December 15, 2025

A Consumer Proposal puts an R7 rating on your credit report. This rating stays for three (3) years after you finish paying. Therefore, the fastest way to fix your credit is to pay off the proposal as fast as possible.

Most proposals are "Open," meaning you can pay them off early without penalty. But where do you find the money?

Work Bonuses & Overtime: In a Bankruptcy, extra income is penalized (Surplus Income). In a Proposal, it is usually yours to keep. If you work overtime or get a Christmas bonus, send 100% of it to the Trustee to attack the principal.

Selling "Non-Exempt" Assets: Do you have a motorcycle, a second car, or a boat that you don't need? Selling these assets and giving the lump sum to the Trustee drastically reduces your term.

The "Side Hustle" Rule: Gig economy income (Uber, SkipTheDishes) is powerful. Earning just $200 extra a month allows you to make a "Double Payment" every few months, shaving years off your sentence.

The Tax Refund Strategy: Did you know that unlike in Bankruptcy, you generally get to keep your tax refunds in a Consumer Proposal? This annual windfall is one of the most powerful tools for debt freedom. By applying your full refund directly to your proposal principal each year, you can mathematically cut 12-24 months off your payment term. Our Phoenix Strategy Bundle explains exactly how to structure this payment to ensure it goes to the principal.

Accelerating with Government Credits: Many Albertans overlook GST/HST credits and other support from the government (like Child Benefits if you have children). These are exempt funds that belong to you. While small on their own, aggregating them into a "freedom fund" can make a massive difference over 5 years. We provide a full breakdown of how to use these credits strategically in the Phoenix Strategy Bundle.

Buy Back Your Time

The difference between a 5-year recovery and a 2-year recovery is often just strategy. By using "found money" like tax refunds and side hustles, you aren't just paying off debt; you are buying back years of your life where you can have a perfect credit score. Start your plan on Day 1.

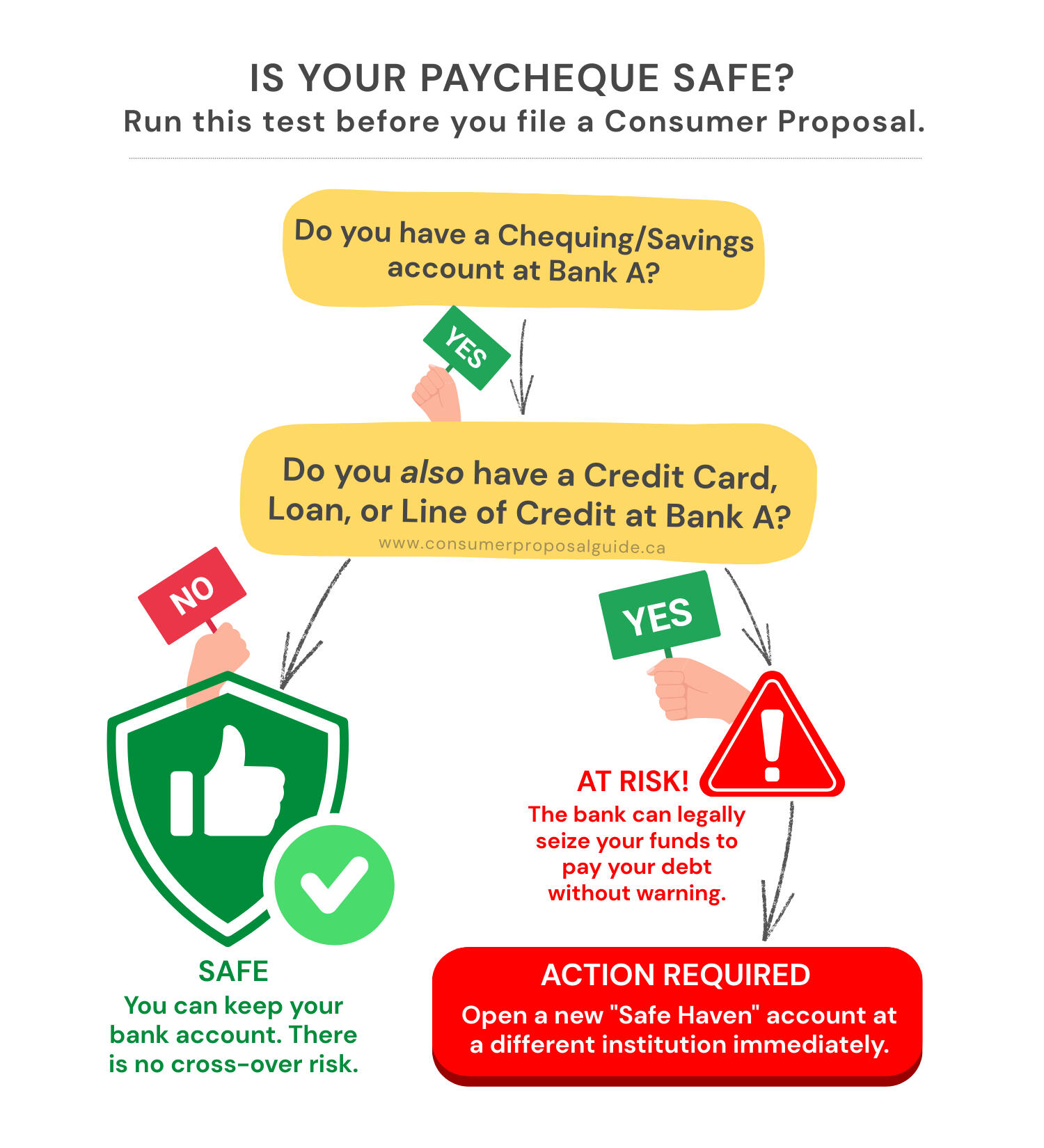

Why You Must Switch Banks Before Filing Insolvency

The "Right of Offset" Danger: Why Your Chequing Account Could Be Frozen

December 15, 2025

Imagine filing your proposal on Monday, and waking up Tuesday to find your chequing account empty. Your rent money is gone. Your grocery money is gone.

This happens because of the Right of Offset.

If you have a credit card/loan with Bank A, and a chequing account with Bank A, they have the legal right to seize funds from your chequing account to pay the debt the moment you file for insolvency.

The Solution:

You must open a new account at a bank where you owe $0.

Switch immediately. Do not wait until the day you file. Open the new account two weeks prior and move your payroll direct deposit. This protects your cash flow.

Right now, and for the next few years while you are on Consumer Proposal, every dollar counts. Paying $15/month for a bank account is a waste ($900 over 5 years). Switch to a no-fee digital bank. An example of that is Wealthsimple, but there are other options. We have them listed in our "Tools" page.

Another option are local credit unions which are often safer because they are separate entities from the "Big 5" banks.

Identifying "Safe Haven" Banks

Not all digital banks are safe. Some popular online banks are actually subsidiaries of major lenders (for example, Simplii is owned by CIBC). If you owe money to the parent company, your money is still at risk. You need a verified "Safe Haven" institution with no cross-over risk. Our Phoenix Strategy Bundle includes a curated list of the top 3 digital banks that are completely independent and safe for insolvency filers.

Protect Your Cash Flow

Filing for insolvency is stressful enough without waking up to frozen accounts. Taking the step to switch banks before you file is one of the most critical defensive moves you can make. Ensure your money is in a safe haven so you can focus on your recovery.

Student Loans & Consumer Proposals: The 7-Year Rule Explained

Student Loans & Insolvency: 5 Rules You Must Know

December 15, 2025

Student loans are the only debt that the government protects from insolvency -- unless you meet specific criteria. If you get this wrong, you could finish your proposal and still owe $30,000.

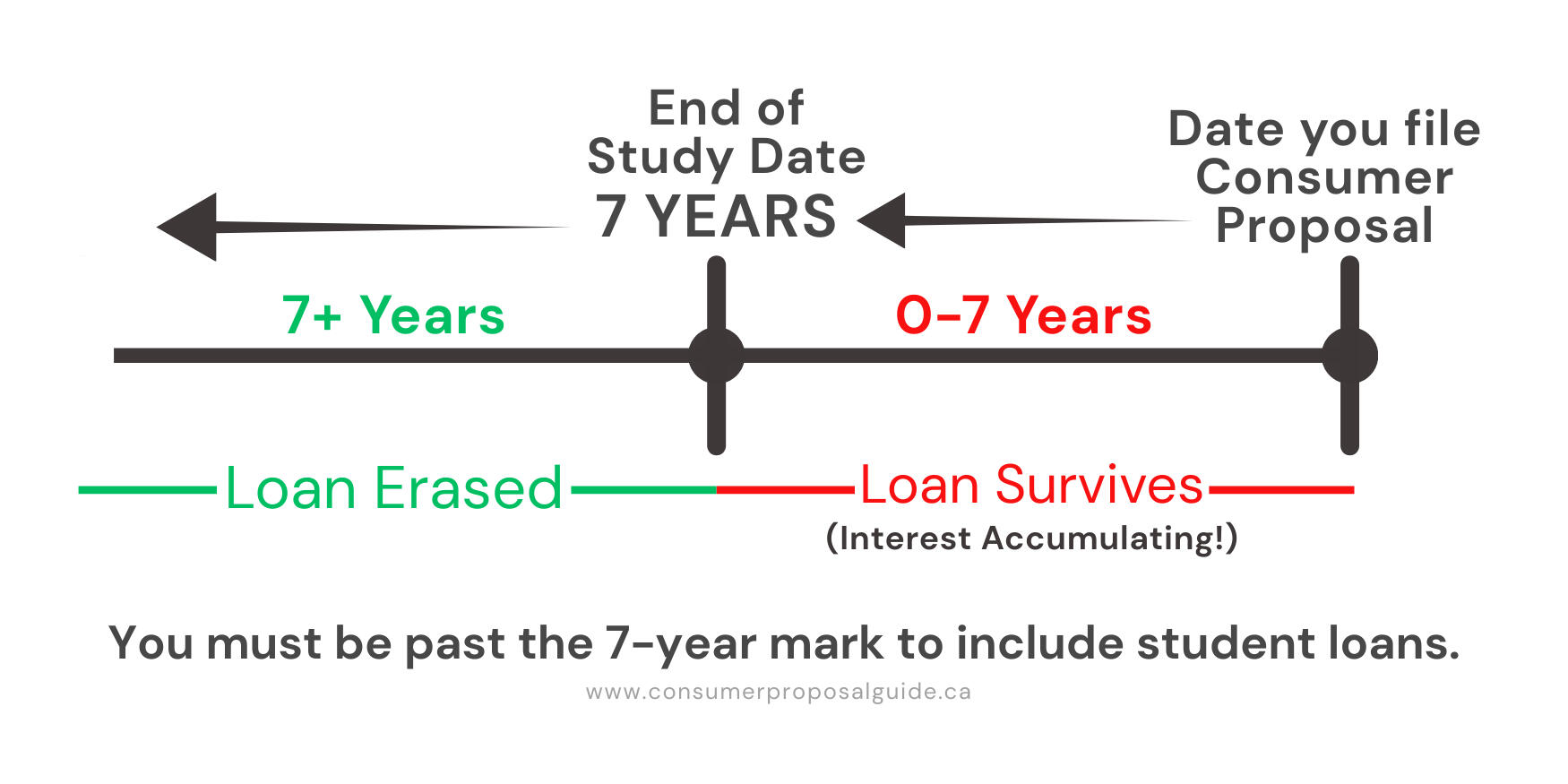

The 7-Year Rule (Section 178 BIA)

Government student loans are only discharged if it has been more than 7 years since you ceased to be a full-time or part-time student.

Example: You graduated in 2015. You file in 2025. Result: Debt Gone.

Example: You graduated in 2020. You file in 2025. Result: Debt Survives.

If your loan survives (less than 7 years), interest continues to grow while you are in your proposal. Ignoring it is dangerous. Even if you are not required to do so while in proposal, it is highly recommended that payment is made towards Student Loans if budget allows to avoid interest from being added on top of the outstanding balance. Speak with your Licensed Insolvency Trustee if you want to do this because they will need to formally inform NSLSC and Alberta Student Loans (or whatever applies in your province).

While you are in a proposal, you can use the Repayment Assistance Plan (RAP) to legally reduce your payments to $0, and the government covers the interest that continues to accrue. This keeps your loan in "Good Standing" (R1 Rating) even while you pay nothing. We explain exactly how to align your RAP application with your Proposal in the Phoenix Strategy Bundle.

The "End of Study" Date

Do not guess this date. Login to your NSLSC account or call them. Even taking a single one-week course resets the clock. You need the official "Ceased to be a Student" date.

The "Hardship Provision" Exception

There is a lesser-known legal provision that can erase student loans after only 5 years (instead of 7) if you can prove "undue hardship" in court. This is not automatic, but it is a potential lifeline for those who qualify. Our Phoenix Strategy eBook details the specific eligibility criteria and the legal steps required to apply for this provision.

Managing the Survivor Debt

Just because a student loan survives the proposal doesn't mean it has to drown you. By using government tools like RAP and understanding the Hardship Provision, you can keep the loan under control while you focus on clearing your other debts. Knowledge is your best defense against compounding interest.

PRIVACY POLICY

Last Updated: December 14, 20251. INTRODUCTION

ConsumerProposalGuide.ca ("we," "us," or "our") respects your privacy. This policy explains how we collect, use, and protect your personal information in compliance with Canadian privacy laws, including PIPEDA.2. INFORMATION WE COLLECT

2.1 Personal Information: When you purchase a Kit or sign up for our newsletter, we collect your name and email address. We do NOT collect sensitive financial data (like SIN numbers or bank account details) directly; payment processing is handled securely by our third-party provider (Stripe/Lemon Squeezy).

2.2 Usage Data: We automatically collect non-personal information via cookies, such as your IP address, browser type, and pages visited, to analyze site performance.3. HOW WE USE YOUR INFORMATION

We use your data to:

- Deliver the digital products you purchased.

- Send you important updates regarding the product or insolvency law changes.

- Respond to your customer service inquiries.

- Track the effectiveness of our marketing campaigns.4. DISCLOSURE OF INFORMATION

We do not sell, trade, or rent your personal identification information to others. We may share generic aggregated demographic information not linked to any personal identification information regarding visitors and users with our business partners and trusted affiliates.5. THIRD-PARTY TRACKING & AFFILIATES

We participate in affiliate marketing programs (including Fintel Connect). These programs use tracking cookies to determine if you clicked a link on our site and purchased a product from a partner (e.g., a bank). This allows us to earn a commission. These third parties have their own privacy policies.6. DATA SECURITY

We adopt appropriate data collection, storage, and processing practices and security measures to protect against unauthorized access to your personal information.7. CONTACT US

If you have questions about this Privacy Policy, please contact us at: [email protected].

TERMS OF SERVICE AND USER AGREEMENT

Last Updated: December 14, 20251. INTRODUCTION

Welcome to ConsumerProposalGuide.ca (the "Website"). By accessing this Website, purchasing our products (the "Kits"), or downloading our resources, you agree to be bound by these Terms of Service. If you do not agree, you must not use this Website.2. NO PROFESSIONAL ADVICE DISCLAIMER (CRITICAL)

2.1 Not Legal or Insolvency Advice:

The information provided on this Website and within our Kits (including but not limited to the "Phoenix Strategy eBook," "Filing Checklists," and "Budget Templates") is for educational and informational purposes only.

2.2 No Professional Relationship:

We are NOT Licensed Insolvency Trustees (LITs), lawyers, financial advisors, or accountants. Your use of this Website does not create a solicitor-client, trustee-debtor, or fiduciary relationship.

2.3 Independent Verification Required:

Insolvency laws (specifically the Bankruptcy and Insolvency Act) are complex and subject to change. You expressly agree that you should consult with a qualified Licensed Insolvency Trustee before making any legal decisions regarding your debt. You are responsible for verifying all information before filing any official documents.3. LIMITATION OF LIABILITY

To the fullest extent permitted by applicable law, ConsumerProposalGuide.ca and its owners, employees, and affiliates shall NOT be liable for any direct, indirect, incidental, or consequential damages resulting from:

(a) Your use or inability to use the Kit materials;

(b) Errors, mistakes, or inaccuracies in the content;

(c) The outcome of any Consumer Proposal or legal filing you undertake;

(d) The rejection of your proposal by creditors.You assume full responsibility for your financial decisions.4. INTELLECTUAL PROPERTY

All content included in the Kits (elections, templates, eBooks, graphics) is the intellectual property of ConsumerProposalGuide.ca.

4.1 Limited License:

You are granted a non-exclusive, non-transferable license to use the Kit for your personal financial restructuring.

4.2 No Resale:

You may NOT redistribute, resell, share, or reproduce the Kit materials for commercial purposes.5. REFUND POLICY

Due to the digital nature of our products (downloadable PDF and Excel files), all sales are generally considered final once the download link has been accessed. However, we offer a 7-day satisfaction guarantee. If you believe the content did not provide the value promised, please contact us at [email protected] for a case-by-case review.6. AFFILIATE LINKS

This Website contains links to third-party websites. We may receive a commission if you purchase products or services through these links. We are not responsible for the content or practices of these third-party sites.

ADVERTISING & AFFILIATE DISCLOSURE

Transparency is our core value.ConsumerProposalGuide.ca is an independent, advertising-supported publisher. We believe you have the right to know how we make money.1. HOW WE ARE FUNDED

We are not a bank, lender, or Licensed Insolvency Trustee. To keep our content free and our Kits affordable, we participate in affiliate marketing programs. This means that if you click on a link to a financial product (such as a secured credit card, bank account, or credit monitoring service) and make a purchase or sign up, we may receive a commission.2. NO EXTRA COST TO YOU

These commissions come at no additional cost to you. In many cases, our partnership links may unlock special offers or lower rates.3. EDITORIAL INDEPENDENCE

Our recommendations are based on research, testing, and the specific needs of individuals in insolvency proceedings.We do not recommend products solely because they pay a commission.We do not accept payment to write favorable reviews.Our "Phoenix Strategy" methodology prioritizes your recovery over affiliate earnings.4. LIST OF PARTNERS

We may have financial relationships with the following types of companies:- Secured Credit Card Issuers (e.g., Neo Financial, Home Trust)

- Digital Banks (e.g., EQ Bank, Simplii)

- Credit Bureaus & Monitoring Services (e.g., Borrowell)Your trust is more important than any commission. If you have questions about our partners, please email us.

The Fresh Start Curriculum

Recovery requires more than just paperwork—it requires a new operating system.

These are the books I used to re-wire my brain, my budget, and my bank account. This page will keep getting updated with new books I think would help us in our journey.

Transparency: These are books I actually read and use. As an Amazon Associate, I earn from qualifying purchases at no extra cost to you.

The Strategy (The How-To Manuals)

For the CEO who needs a tactical plan to beat the system.

Written by a Canadian Licensed Insolvency Trustee, Doug Hoyes. This book is essential for de-programming the guilt and realizing that a Consumer Proposal is simply a business decision, not a moral failure.

Consider this your Bootcamp Manual. You have 60 months of strict budgeting ahead of you; Gail’s "Jar System" is the most practical way to manage cash flow without losing your mind.

The Canadian classic on paying yourself first. This proves that you can build wealth even while you are on a restricted proposal budget. It shifts you from "survival mode" to "growth mode."

While technically a business book, this is the ultimate operating system for household cash flow. It forces you to prioritize your savings and debt repayment first, making a 5-year proposal manageable without relying on willpower.

The Mindset (The Therapy)

For the CEO who feels guilty, ashamed, or frozen by anxiety.

This guide validates the emotional debt cycle. It is the best resource for learning how to separate your Self-Worth from your Net-Worth so you can lead your family with confidence again.

If you want to ensure you never end up in this position again, you have to fix the root cause. This digs into the scarcity mindset and trauma often linked to debt, stopping self-sabotage for good.

Debt thrives in silence. This book empowers you to have the difficult conversations—with your spouse, your kids, and your bank—without feeling small.

High performers often feel miserable because they measure success against the what's "ideal." This book teaches you to measure backward, against where you started. It is the quickest path to finding peace and confidence in the middle of a messy turnaround.

The Lifestyle (The Rebuild)

For the CEO who is using this 5-year period to upgrade their life.

Success isn't about willpower; it's about systems. This teaches you how to build tiny, 1% habits (like tracking spending daily) that make financial success automatic rather than a struggle.

A proposal forces you to live with less. This inspiring memoir proves that a "low-buy" life can actually be richer, happier, and more fulfilling than the one you are leaving behind.

This is for the long game. It shifts your focus from getting rich quick to staying wealthy through patience and behavior. Read this while you wait for your Discharge certificate.

Once the debt is gone, what is next? This is the "Gold Standard" manual for ETF investing. It strips away the confusion of the stock market and gives you a simple, proven roadmap to Financial Independence.

UPGRADE TO TIER 3

Transparency is our core value.ConsumerProposalGuide.ca is an independent, advertising-supported publisher. We believe you have the right to know how we make money.1. HOW WE ARE FUNDED

We are not a bank, lender, or Licensed Insolvency Trustee. To keep our content free and our Kits affordable, we participate in affiliate marketing programs. This means that if you click on a link to a financial product (such as a secured credit card, bank account, or credit monitoring service) and make a purchase or sign up, we may receive a commission.2. NO EXTRA COST TO YOU

These commissions come at no additional cost to you. In many cases, our partnership links may unlock special offers or lower rates.3. EDITORIAL INDEPENDENCE

Our recommendations are based on research, testing, and the specific needs of individuals in insolvency proceedings.We do not recommend products solely because they pay a commission.We do not accept payment to write favorable reviews.Our "Phoenix Strategy" methodology prioritizes your recovery over affiliate earnings.4. LIST OF PARTNERS

We may have financial relationships with the following types of companies:- Secured Credit Card Issuers (e.g., Neo Financial, Home Trust)

- Digital Banks (e.g., EQ Bank, Simplii)

- Credit Bureaus & Monitoring Services (e.g., Borrowell)Your trust is more important than any commission. If you have questions about our partners, please email us.